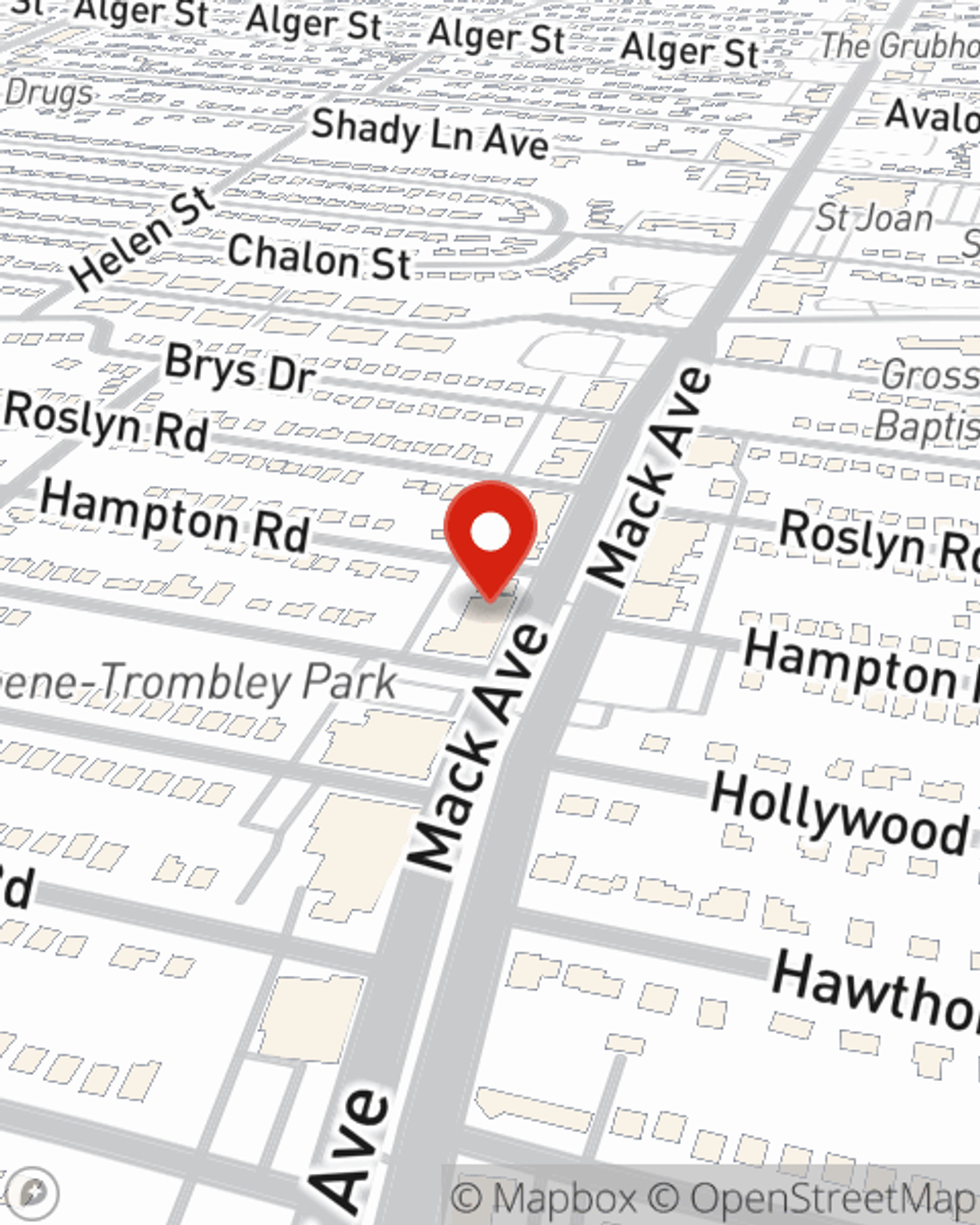

Life Insurance in and around Grosse Pointe Woods

Get insured for what matters to you

What are you waiting for?

Would you like to create a personalized life quote?

- Grosse Pointe Woods

- Harper Woods

- St. Clair Shores

- Eastpointe

- Roseville

- Grosse Pointe Shores

- Grosse Pointe Farms

- Grosse Pointe Park

- Clinton Township

- Harrison Township

- Metro Detroit

- Warren

- Shelby Township

- Rochester Hills

- Riverview

- Troy

- Madison Heights

- Birmingham

- West Bloomfield

- Bloomfield Hills

- Auburn Hills

- Sterling Heights

- Romeo

- Chesterfield

It's Time To Think Life Insurance

People choose life insurance for individual reasons, but the goal is always the same: to secure the financial future for your partner after you perish.

Get insured for what matters to you

What are you waiting for?

Their Future Is Safe With State Farm

But what coverage do you need, considering your situation and your loved ones? First, the type and amount of insurance you choose should correspond with your current and future needs. Then you can consider the cost of a policy, which is calculated using the age you are now and how healthy you are. Other factors that may be considered include occupation and lifestyle. State Farm Agent Janet Coates can walk you through all these options and can help you determine how much coverage is right for you.

To learn more about State Farm's Life insurance options, call or email Janet Coates's office today!

Have More Questions About Life Insurance?

Call Janet at (313) 332-0676 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Janet Coates

State Farm® Insurance AgentSimple Insights®

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.